|

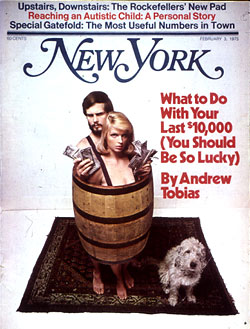

From the February 2, 1975 issue of New York Magazine.

But first a joke.

This broker calls his customer in 1970 and puts him into Penn Central. In '71 he calls and they go into Levitz Furniture, "for the long pull." In '72 it's Rite Aid at 54¼. And in '73 he calls to tout Equity Funding. In 1974, the customer calls the broker and says, "Look: I don't know about all these stocks we've been buying—I think maybe I'd be better off in bonds." "Yeah, sure," says the broker, "but what do I know about bonds?"

So it has finally happened. A year ago you switched your last thousand shares of U.S. Steel, at $40 apiece, into a thousand shares of Chase Manhattan's real-estate investment trust, also at $40 apiece, for the yield. (I know of a man who actually did that.) Chase Manhattan, for crying out loud. And now, with the Chase trust down around 6, plus what you have left in Pan Am and a credit at Saks, you are down to your last $10,000. (Some of us should be so lucky.) What should you do with it?

Granted, this is a highly individual question. It depends on things like your age, your tax bracket, the number of dependents you have, your financial sophistication (which obviously wasn't all it might have been), and so on. Largely it depends on what the business schools call your "risk profile"—the trade-off you choose between "eating well and sleeping well."

It is also very important to establish which last $10,000 this is. If it's really your last $10,000—all you have—then you should almost certainly put most or all of it into your local savings bank. You may need it. Only if you were quite young, with no dependents, and with a slush fund to fall back on if necessary, such as parents, could you prudently consider investing your last $10,000 in something much more aggressive than a savings bank or (read on) a money-market mutual fund.

But assuming one already has what he considers to be adequate savings, adequate life insurance, a secure job, and a mortgage he can handle—and that this $10,000 is what's left of money he had set aside for long-term investment rather than for year-to-year operating expenses—what should he do to try to build it back into something meaningful? Should that $10,000 go into the savings bank also?

We asked 21 people for their advice, and every one of them, amazingly enough, told us to buy stock in Shoney's Big Boy Enterprises!

No, scratch that. (I just picked the name at random from my stock guide.) As you would expect, we came up with a wide range of conflicting advice:

First, there was the point of view of those who felt, as Henry Rice, a respected real-estate consultant, put it, that "$10,000 just ain't money anymore. It's not a big enough chip for an investment program." What's a meaningful chip? "I think you would have to raise it to $100,000." You could put $10,000 in the market, he says, but he thinks you would probably be better off in a savings bank. As for real estate, he says, there is no reasonable way for you to invest just $10,000—unless you are the mechanical type that wants to run a tenement. Even then, he says, you would make money not so much from the investment of your capital as from your own skills and labor. "Saving on plumbers' bills by coming around at night in your overalls, and that sort of thing." My friend Laura Sloate, who heads her own small brokerage firm, agrees about the size of the chip. "I don't believe in investing anything less than $100,000 at risk. I would put the $10,000 in an income trust. Fidelity Daily Income Trust, probably [in Boston—800 225-6190]." You can invest as little as $1,000 or $5,000 in most such trusts, also known as "money-market mutual funds." They buy the high-yielding securities denominated in hundreds of thousands or millions of dollars that small investors cannot afford. The money you invest is not insured, but except in the grimmest of circumstances is quite safe.

NBC economic correspondent Irving R. Levine, the only network reporter with a middle initial, agrees with this approach. "Even though inflation is going to keep eroding the purchasing power of money," he says, "it nevertheless seems wise to me in a time of economic uncertainty to keep a sizable portion of your money in money. I like the money-market funds. They pay interest on a daily basis, and you can pull your money out just about as quickly as from a savings account, which pays less interest, or even from a checking account, which pays no interest at all."