|

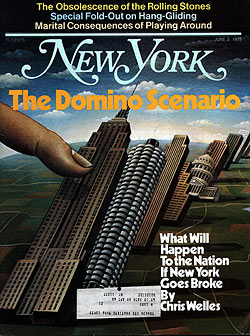

From the June 2, 1975 issue of New York Magazine.

This article went to press on Thursday, May 22. Between that date and when you read this, it is remotely possible that the federal, New York State, and New York City governments and the financial community will have come up with a dramatic, lasting solution to New York's financial crisis, which has brought the city to the brink of defaulting on its obligations. If such a miracle has really transpired, you can skip to the next article.

It is far more likely that if anything has been done about the crisis it has been some stopgap "muddling through" measure—probably a combination of federal and state aid or guarantees, new city taxes, and modest expense cuts—which, while solving none of the city's underlying problems, postpones the chance of a default a few months, perhaps a year. It is more likely still, as you read this, that nothing will have been resolved and that the various parties will still be lurching toward an arguably well-deserved apocalypse which could well be as serious as the one portrayed below, and which could come less than one week from now.

Considering the haste with which the operation had been arranged, it was incredible that things had gone so smoothly. Not until President Ford's television address during the evening of June 1, 1975, did the public learn that Fort Knox was being closed down and that over the weekend all of the country's 8,600 metric tons of gold had been secretly transported by truck to seaports and loaded on tankers which, even as he spoke, were steaming under navy escort to Saudi Arabia and Iran.

Giving the nation's gold stocks to the Middle East oil producers was a drastic step, of course. But to government officials, some of whom had long sought to demonetize gold, it seemed a relatively small price to pay for the willingness of the oil producers to refloat the United States' $200-billion municipal-bond market by guaranteeing all outstanding obligations and to provide the United States with a $100-billion, low-interest line of credit. The "muni" market's collapse following the default by New York City the previous Friday on $220-million worth of short-term notes had thrown the financial structures of many large cities and states into chaos, had severely weakened the liquidity of the banking system, had aroused skepticism as to the ability of even the U.S. government to pay its debts, and had precipitated the beginnings of a run on Treasury securities.

How could it have happened? Those who had been involved were the country's best and brightest political and financial leaders, well-intentioned men with every motivation to avoid such a debacle. Why had they been unable to prevent it?

Eventually, during agonizing postmortems, many ruefully came to see the events which led to the default as something like the game of chicken in Rebel Without a Cause, when several teen-agers one dark night drove old cars toward a cliff, the goal being to be the last to jump out before the car went over the edge. In this case, the parties were all so confident the others would jump first that none jumped in time and all fell to the rocks below.

The federal government and the government of New York State were concerned with beating New York City, which they felt had brought on the crisis. As they saw it, the city had been following a fiscally ruinous course for years by spending much more money than it was able to generate. Few had questioned philosophically the goodness of what the city was spending its money for. Who could argue against health care, education, and police and fire protection? The problem was that the city had been trying to do too much for too many with too little. During the last decade, the city's expense budget—$11.8 billion during the 1974-75 fiscal year—had grown at an annual rate of 12 per cent, while tax revenues had increased only 4 to 5 per cent.

The difference between what came in and what went out created an annual budget gap. By state law, which governs all city affairs, that gap must be closed each year. Gap-closing had developed into an elaborate ritual involving complex political maneuvering and arcane accounting manipulation.

Five gap-closing options were employed in various degrees. One was new taxes. While very important, this option unfortunately had some counterproductive effects. Higher taxes eviscerated the city's none-too-healthy economic base, driving out businesses and affluent residents resentful of the extent to which their wealth was being redistributed to the city's less fortunate residents. An ever larger percentage of the city's population thus had become dependent on city services, while the city's financial resources to provide those services at accustomed levels had declined. Continual increases in all-important real-estate taxes, which account for a quarter of city revenues, increased abandonments and delinquencies.