|

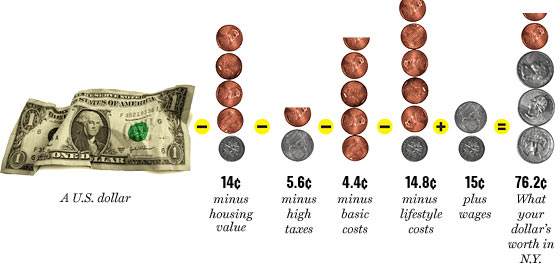

What if New York had its own currency? In a sense, it already does. Our dollar looks the same as the better-known U.S. version, but it doesn’t go nearly as far here as anywhere else. How much is it really worth? Based on a few scientifically imprecise calculations, a New York dollar would lag somewhere behind a Canadian buck. Here’s why:

HOUSING

A 2002 study by Michael H. Schill, then a professor at New York University Law School, concluded that a host of factors—regulations, zoning, unions, the building code—made the cost of building a home one-third higher in New York City than in 21 other cities. Nationwide, housing and shelter eat up 42 percent of a typical consumer’s disposable income. For a buyer to acquire New York housing that’s equivalent in quality to the same type elsewhere, he would have to use 56 percent of his disposable income. The New York dollar loses 14 cents: 86 cents.

TAXES

An annual study by the city of Washington, D.C., compares tax burdens in large cities. A hypothetical family of four living on $150,000 in New York would pay the nation’s highest combination of sales, auto, income, and property taxes: about $22,635, or 15.1 percent of income. By comparison, the national median is $14,219, or 9.5 percent. That’s another $8,416 extra per year here, or another 5.6 cents. Our dollar is down to 80.4 cents.

BASIC COSTS

The Bureau of Labor Statistics says overall prices here are 9.9 percent higher than the rest of the country. Remove the premium New Yorkers pay for housing and the currency is debased another 4.4 cents, to 76 cents.

LIFESTYLE COSTS

Less quantifiable is the price of status, which tends to matter more in New York than elsewhere. You might be the best-dressed guy at a Minneapolis cocktail party rocking a Hugo Boss suit ($695) from Macy’s, but it might take a Thom Browne suit from Barneys ($4,330) to do the trick here. While these costs are difficult to measure, it is possible to calculate the added price of living in a city with the best of everything. Yes, we have better art, food, and entertainment, but you’ll pay a premium for access to it. Here, a side-by-side look at lifestyle purchases in Minneapolis—a city with a statistically average cost of living yet some semblance of a cultural life—and New York:

Baseball tickets

Twins premium seats . . . . . $24

Yankee loge box seats . . . . . $50

Museum admission

Walker Art Center . . . . . . . . . $8

MoMA . . . . . . . . . . . . . . . . . . $20

Movie ticket

The Prestige, St. Anthony Main Theater . . $8

The Science of Sleep, BAM . . $10

Prix fixe dinner at top restaurant

La Belle Vie . . . . . $80 a person

Per Se. . . . . . . . . . $210 a person

Annual gym membership

Minneapolis Life Time Athletic Club . . $1,439.40

Equinox . . . . . . . . . . . . . . .$1,895

Marathon entry fees

Minneapolis . . . . . . . . . . . . . $85

New York . . . . . . . . . . . . . . . $116

Bottom line? On average, these life-enhancing amenities cost 85 percent more here than in Minneapolis. If we assume that the average American deploys 8 percent of total income on such indulgences, a New Yorker will spend 14.8 cents of every dollar on them. Now we’re down to 61.2 cents.

WAGES

New York is a high-wage town, up and down the income scale. Mercer Human Resource Consulting notes that a job that pays $30,000 on a national median will pay $36,720 in New York, compared with $27,840 in Birmingham, Alabama. According to The American Lawyer, a first-year associate at Manhattan’s Cravath, Swaine & Moore can expect to make $145,000, while those at Dorsey & Whitney in Minneapolis can expect just $105,000, 28 percent less. Assuming the wage premium in New York is a generous 15 percent, you add back 15 cents. Now the New York dollar is worth 76.2 cents.

These cold calculations omit some other important factors, like ambition. Here in Gotham, a junior banker can aspire to a partnership at Goldman Sachs; a first-year associate lawyer to a partnership at Cravath; a waitressing actress to Broadway. Any of these dreams, if realized, will bring outsize psychic and financial rewards that simply aren’t available in Minneapolis.

And then there are the intangibles. What price do you place on jogging around the reservoir in Central Park? On the Union Square Greenmarket? On home delivery of Vietnamese food? If the value of a dollar were the only consideration, the vast majority of New Yorkers would be better off in Saginaw, Michigan; Portsmouth, Ohio; and Rock Island, Illinois—cities with the most salubrious combination of low costs and comparatively high wages, according to Salary.com. In that survey, New York ranks dead last. But how many college graduates are moving to Rock Island this year?